Hello, guys if you’re into investing or just starting to explore the world of mutual funds, you might have heard about the 7-5-3 rule for equity SIPs (Systematic Investment Plans). It’s a simple, yet effective strategy to help you grow your wealth over time by investing smartly in the stock market. But what exactly does this rule mean, and how can you apply it to your investments?

In this blog, we’ll break down the 7-5-3 equity SIP rule, explain how it works, and show why it’s a smart guideline for anyone looking to invest in equities through SIPs.

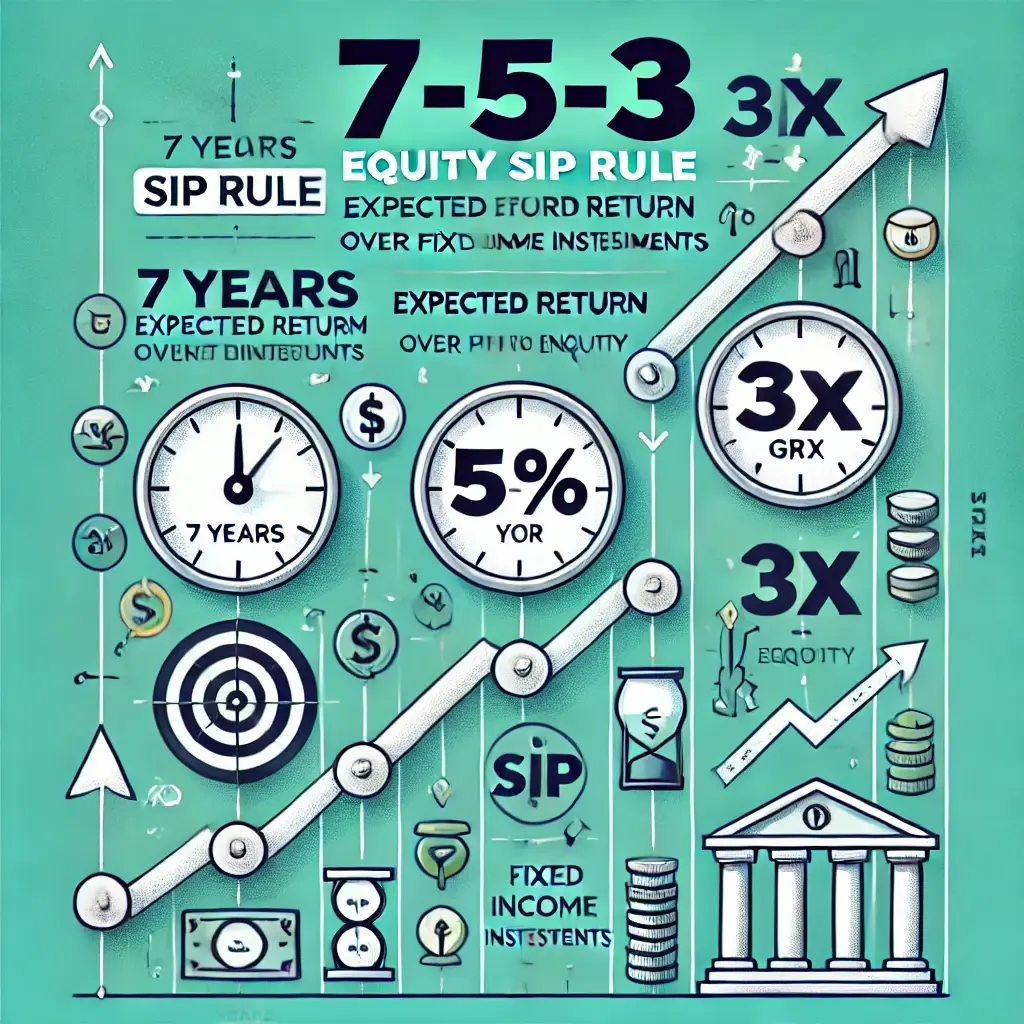

What is the 7-5-3 Rule in Equity SIPs?

The 7-5-3 rule is a straightforward principle that helps investors set expectations and goals when investing in equity mutual funds through SIPs. Here’s what each number stands for:

7 Years: Invest in equity mutual funds for at least 7 years. Equity markets can be volatile in the short term, but they tend to stabilize and generate better returns over a longer period. By staying invested for at least 7 years, you give your money the time it needs to grow and benefit from market cycles.

5%: Expect an average annual return of around 5% more than fixed income instruments (like Fixed Deposits or bonds). Equity investments tend to outperform fixed income options in the long run, but it’s important to set realistic expectations. On average, equity mutual funds can offer returns that beat traditional savings by about 5%.

3 Times: Over time, your investment can potentially grow by 3 times if you follow a disciplined SIP approach. By staying invested and letting your money compound, you have the potential to see your capital triple over a longer horizon.

How the 7-5-3 Rule Works in Practice

Let’s say you start a monthly SIP of ₹20,000 in an equity mutual fund. Here’s how the 7-5-3 rule might play out:

- Invest for 7 years: You consistently invest ₹20,000 every month for 7 years, no matter how the market behaves in the short term. By giving your investment time, you avoid reacting to market fluctuations and stay focused on long-term growth.

- Expect returns of 5% more than fixed income: Let’s assume fixed income instruments give you a return of 6% per year. Equity mutual funds, on the other hand, might give you an average return of around 11% per year (6% + 5%). This extra 5% makes a huge difference over time, thanks to compounding.

- Watch your money grow 3 times: By the end of 7 years, your investment could grow significantly. While this is just a rough estimate, sticking to your SIP for 7 years could see your initial investment amount potentially triple in value, thanks to the power of compounding and the higher returns from equities.

Why is the 7-5-3 Rule Important?

This rule provides a simple framework to help you stay focused and disciplined. Many investors panic when markets are down, pulling out their money too soon. The 7-5-3 rule reminds you to stay invested for the long haul, set realistic expectations, and allow your money the time to grow.

Benefits of the 7-5-3 Rule

- Long-term Focus: It encourages investors to stay committed to their SIPs for at least 7 years, which reduces the temptation to withdraw funds during market volatility.

- Realistic Return Expectations: The rule suggests an achievable 5% higher return compared to fixed income, helping you set realistic financial goals.

- Compounding Effect: By staying invested for longer, the rule leverages the power of compounding, where your returns start generating additional returns over time.

How to Apply the 7-5-3 Rule

Here’s how you can implement the 7-5-3 rule in your SIP journey:

- Choose the Right Equity Fund: Look for a well-performing equity mutual fund with a solid track record. Make sure it aligns with your risk tolerance and long-term goals.

- Start a Monthly SIP: Begin investing a fixed amount every month through an SIP. Automating your investment ensures consistency.

- Stay Invested for 7 Years or More: Trust the process and resist the urge to make quick decisions based on short-term market movements. The 7-year horizon allows the market’s natural ups and downs to even out.

- Track and Review: While the 7-5-3 rule encourages long-term investment, it’s still important to review your portfolio periodically to ensure it aligns with your financial goals.