Mutual fund taxation in India is based on the type of fund—equity or debt—and the holding period of your investment. The tax you pay on mutual fund gains is categorized into two types: Capital Gains Tax and Dividend Distribution Tax (DDT).

Capital Gains Tax on Mutual Funds

Capital gains refer to the profit you make when you sell your mutual fund units for a higher price than the purchase price. The capital gains tax is applied based on your holding period.

- Short-Term Capital Gains (STCG): Gains from investments held for a short period.

- Long-Term Capital Gains (LTCG): Gains from investments held for a longer duration.

The rates for STCG and LTCG differ for equity and debt mutual funds.

Tax Rates for Capital Gains and Income

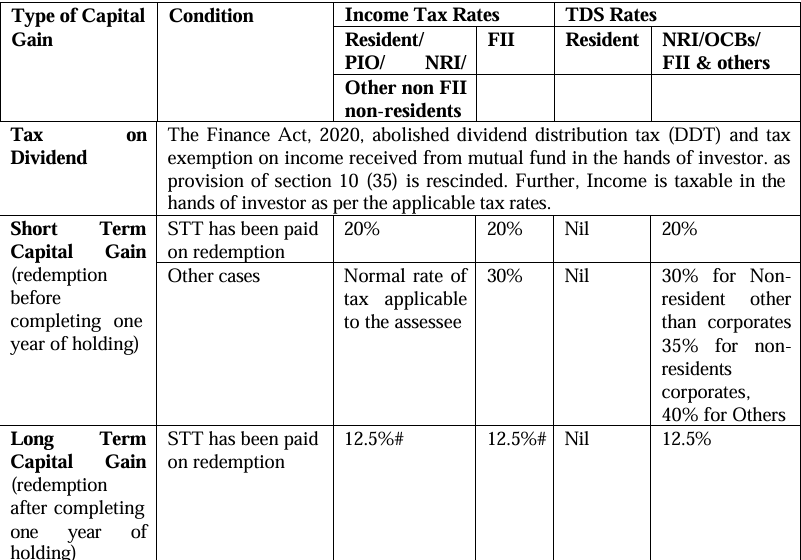

Under Section 112A of the Act, where long-term capital gain exceeds Rs. 1,25,000/- tax is payable at 12.5% plus applicable surcharge and cess (without indexation benefit).

Taxability in the Hands of Investors

- Income Held as Stock-in-Trade: Taxed at the rates applicable to the investor’s normal income.

- Income Held as Investments: Taxed as capital gains, with tax rates depending on whether the gain is classified as short-term or long-term.

Surcharge Rates

| Total Income | Individual/HUF | Partnership Firms & Cooperative Societies | Domestic Companies* | Foreign Companies |

|---|---|---|---|---|

| Less than or equal to 50 lakhs | NIL | NIL | NIL | NIL |

| >50 lakhs <= 1 crore | 10% | NIL | NIL | NIL |

| >1 crore <= 2 crores | 15% | 12% | NIL | 7% |

| >2 crores <= 5 crores | 25% | 12% | 2% | 7% |

| >5 crores <= 10 crores | 37% | 12% | 2% | 7% |

| >10 crores | 37% | 12% | 2% | 12% |

Taxation on Equity Mutual Funds

Equity mutual funds invest primarily (65% or more) in stocks or equity-related instruments. The tax on equity mutual funds is categorized based on the holding period:

- Short-Term Capital Gains (STCG): If you sell your equity mutual fund units within 12 months, the gains are classified as STCG and are taxed at 15%.

- Long-Term Capital Gains (LTCG): If you sell your equity mutual fund units after 12 months, the gains are classified as LTCG. Gains up to ₹1 lakh in a financial year are exempt from tax. Any gains exceeding ₹1 lakh are taxed at 12.5% without the benefit of indexation.

Example: If you make a profit of ₹1.5 lakh after selling your equity mutual funds held for more than a year, only ₹50,000 will be taxed at 12.5% (as ₹1 lakh is tax-exempt).

| Asset Type | Holding Period | STCG |

| Equity mutual funds | Up to 12 months | 20% |

| Debt mutual funds purchased before April 1, 2023 | Up to 24 months | Slab rates |

| Debt mutual funds purchased after April 1, 2023 | Always short-term | Slab rates |

| Domestic equity ETFs | Up to 12 months | 20% |

| International equity ETFs (listed in India) before April 1, 2023 | Up to 12 months | Slab rates |

| International equity ETFs (listed in India) after April 1, 2023 | Up to 12 months | Slab rates |

| International equity ETFs (listed outside India) | Up to 24 months | Slab rates |

| Domestic debt ETFs purchased before April 1, 2023 | Up to 24 months | Slab rates |

| Domestic debt ETFs purchased after April 1, 2023 | Always short-term | Slab rates |

| International debt ETFs purchased before April 1, 2023 | Up to 24 months | Slab rates |

| International debt ETFs purchased before April 1, 2023 | Always short-term | Slab rates |

| All fund of funds | ||

| Equity-oriented (invests minimum 90% in equity-oriented fund and such equity-oriented fund also invests 90% of proceeds in listed equity shares in India) | Up to 12 months | 20% |

| Other funds purchased before April 1, 2023 (less than 65% in debt)* | Up to 24 months | Slab rates |

| Other funds purchased after April 1, 2023 (less than 65% in debt) | Always short-term | Slab rates |

| International fund of funds* | Up to 24 months | Slab rates |

| Gold mutual fund before April 1, 2023 | Up to 24 months | Slab rates |

| Gold ETFs before April 1,2023 | Up to 12 months | Slab rates |

| Gold ETFs after April 1,2023* | Up to 12 months | Slab rates |

| Dynamic/Multi-asset allocation funds | ||

| Aggressive hybrid fund * | Up to 12 months | 20% |

| Balanced hybrid fund * | Up to 24 months | Slab rates |

| Conservative hybrid fund (Purchased before April 1, 2023) | Up to 24 months | Slab rates |

| Conservative hybrid fund (Purchased before April 1, 2023) | Always short-term | Slab rates |

LTCG rates, holding period of various mutual funds

| Asset Type | LTCG |

| Equity mutual funds | 12.50% |

| Debt mutual funds purchased before April 1, 2023 | 12.50% |

| Debt mutual funds purchased after April 1, 2023 | 12.50% |

| International equity ETFs (listed in India) before April 1, 2023 | 12.50% |

| Domestic equity ETFs | 12.50% |

| International equity ETFs (listed in India) after April 1, 2023 | 12.50% |

| Domestic debt ETFs purchased before April 1, 2023 | 12.50% |

| Domestic debt ETFs purchased after April 1, 2023 | Slab rate |

| International debt ETFs purchased before April 1, 2023 | 12.50% |

| International debt ETFs purchased after April 1, 2023 | 12.50% |

| Gold mutual fund before April 1, 2023 | 12.50% |

| Gold mutual fund after April 1, 2023* | 12.50% |

| Gold ETFs before April 1,2023 | 12.50% |

| Gold ETFs after April 1,2023 | 12.50% |

Dividend Distribution Tax (DDT) and the New Dividend Tax Rule

Previously, dividends from mutual funds were subject to Dividend Distribution Tax (DDT), paid by the mutual fund house before distributing dividends to investors. However, from April 1, 2020, DDT has been abolished, and dividends are now taxed in the hands of investors.

- Dividend Tax: Dividends received from mutual funds are taxed as per your income tax slab. For high-income earners, this could result in a higher tax burden than before.

Additionally, if the dividend income exceeds ₹5,000 in a financial year, the mutual fund house deducts a 10% TDS (Tax Deducted at Source) before distributing the dividend.

Securities Transaction Tax (STT)

An Securities Transaction Tax (STT) is levied on the sale of equity mutual funds and equity-oriented hybrid funds. The STT is usually 0.001% of the transaction value and is applicable only on equity-oriented funds, not on debt funds.

How to Calculate Your Tax on Mutual Funds

To calculate the tax on your mutual fund returns, consider:

- Type of Fund (Equity or Debt).

- Holding Period (Short-Term or Long-Term).

- Applicable Tax Rates (15% for STCG in equity funds, income tax slab for STCG in debt funds, etc.).

- Gains Exemptions: ₹1 lakh exemption for LTCG in equity funds.

- Indexation: For LTCG in debt funds, adjust the purchase price for inflation before applying the 20% tax.