Discover how the Tata BSE Select Business Groups Index Fund helps investors track the performance of top Indian businesses. Learn about its benefits, asset allocation, and suitability for long-term capital growth.

Investing in ETFs has become increasingly popular in recent years, providing investors with a convenient and efficient way to diversify their portfolios. One such option is the Tata BSE Select Business Groups Index Fund, an open-ended scheme tracking the Index.

Tata BSE Select Business Groups Index Fund

The Tata BSE Select Business Groups Index Fund is a passively managed index fund that aims to replicate the performance of the BSE Select Business Groups Index (TRI). This open-ended scheme invests primarily in equity and equity-related instruments of companies listed on the BSE Select Business Groups Index. With a goal of long-term capital appreciation, the fund is ideal for investors who prefer a passive, low-cost investment strategy.

Key Points:

- Replicates the BSE Select Business Groups Index.

- Invests at least 95% of assets in the index’s securities.

- Suitable for investors seeking long-term growth.

Why Choose This Fund

This index fund is designed for investors who want exposure to a broad range of prominent Indian companies without the need for active management. With at least 95% of the portfolio invested in the index, the fund ensures that your investments stay aligned with the top-performing business groups in India.

Benefits of the Fund:

- Low-cost investment: As a passive fund, management fees are kept minimal.

- Diversification: Exposure to various sectors and companies within the BSE Select Business Groups Index.

- Long-term growth potential: Ideal for investors aiming for sustained capital appreciation.

THE SCHEME ALLOCATE ITS ASSETS

Index Constituents as on 23rd September, 2024

| Security Name | Weights % | Impact Cost % (as on 30th September, 2024) |

|---|---|---|

| RELIANCE INDUSTRIES LTD. | 23.00 | 0.03 |

| LARSEN & TOUBRO LTD. | 13.09 | 0.02 |

| MAHINDRA & MAHINDRA LTD. | 8.01 | 0.02 |

| TATA CONSULTANCY SERVICES LTD. | 7.16 | 0.02 |

| ULTRATECH CEMENT LTD. | 3.96 | 0.02 |

| TATA MOTORS LTD. | 3.32 | 0.02 |

| ADANI PORTS AND SPECIAL ECONOM. | 3.12 | 0.03 |

| TECH MAHINDRA LTD. | 3.12 | 0.03 |

| GRASIM INDUSTRIES LTD. | 3.09 | 0.02 |

| HINDALCO INDUSTRIES LTD. | 2.99 | 0.02 |

| JSW STEEL LTD. | 2.76 | 0.03 |

| TRENT LTD. | 2.72 | 0.02 |

| TITAN COMPANY LIMITED | 2.61 | 0.02 |

| Adani Green Energy Limited | 2.16 | 0.04 |

| ADANI ENTERPRISES LTD. | 2.12 | 0.03 |

| TATA STEEL LTD. | 2.07 | 0.03 |

| ADANI POWER LTD. | 1.74 | 0.03 |

| LTIMindtree Limited | 1.73 | 0.03 |

| AMBUJA CEMENTS LTD | 1.30 | 0.04 |

| TATA CONSUMER PRODUCTS LIMITED | 1.29 | 0.03 |

| TATA POWER CO.LTD. | 1.24 | 0.03 |

| JSW ENERGY LTD | 1.21 | 0.05 |

| JINDAL STEEL & POWER LTD. | 1.12 | 0.05 |

| Adani Energy Solutions Limited | 1.11 | 0.03 |

| INDIAN HOTELS CO.LTD. | 1.01 | 0.03 |

| VOLTAS LTD. | 0.95 | 0.03 |

| ADANI TOTAL GAS LIMITED | 0.69 | 0.04 |

| ACC LTD. | 0.49 | 0.03 |

| TATA ELXSI LTD. | 0.38 | 0.03 |

| TATA COMMUNICATIONS LTD. | 0.36 | 0.03 |

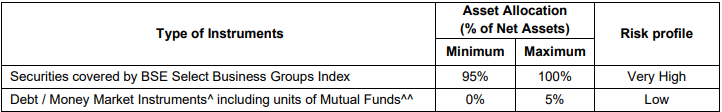

Investment allocation pattern of the scheme

- Equity and equity related instruments and/ or equity derivatives.

- Debt and money market instruments.

- Units of Domestic Mutual Funds

Tata BSE Select Business Groups Index Fund Investment Strategies

The fund is a passively managed index fund designed to closely follow the performance of the BSE Select Business Groups Index (TRI). It achieves this by investing in the same stocks, in the same proportion, as the index itself. At least 95% of the fund’s total assets will be invested in the securities that make up the index, while the remaining portion may go into debt or money market instruments, including mutual fund units, to handle liquidity and cover expenses.

This fund is a great option for investors who want to invest in a hands-off portfolio made up of companies within the BSE Select Business Groups Index.

Who Should Invest in This Fund?

The Tata BSE Select Business Groups Index Fund is perfect for investors who:

- Prefer passive management and low expense ratios.

- Want to invest in a diverse range of leading Indian companies.

- Seek long-term capital growth with minimal short-term trading.

Final Thoughts

If you are an investor looking for an affordable, long-term, and hands-off approach to investing in top Indian companies, the Tata BSE Select Business Groups Index Fund is worth considering. By tracking the BSE Select Business Groups Index, the fund provides a simple yet effective way to participate in India’s economic growth.

Read more :- Mutual Fund Taxation: Important Information for Investors