Explore the Groww Nifty 500 Momentum 50 ETF, an open-ended exchange-traded fund (ETF) designed to track the Nifty 500 Momentum 50 Index. Learn about its features, risks, and investment potential.

Investing in ETFs has become increasingly popular in recent years, providing investors with a convenient and efficient way to diversify their portfolios. One such option is the Groww Nifty 500 Momentum 50 ETF, an open-ended scheme tracking the Nifty 500 Momentum 50 Index.

What is the Groww Nifty 500 Momentum 50 ETF?

The Groww Nifty 500 Momentum 50 ETF is designed to offer investors exposure to the Nifty 500 Momentum 50 Index. This index consists of 50 stocks from the Nifty 500 that show the highest momentum, making it an attractive option for those seeking long-term capital appreciation.

Key Highlights:

- Type: Open-ended exchange-traded fund

- Objective: To provide returns that closely correspond to the performance of the Nifty 500 Momentum 50 Index, before expenses.

- Risk: High, due to the nature of equity market investments.

Why Consider the Groww Nifty 500 Momentum 50 ETF?

Investors who are seeking long-term capital growth and are comfortable with market volatility may find this ETF appealing. Here are some of the reasons why it stands out:

- Diversification: By investing in a range of high-momentum stocks, the ETF provides a diversified exposure to various sectors.

- Cost-Efficient: ETFs tend to have lower expense ratios compared to actively managed funds, and the Groww Nifty 500 Momentum 50 ETF is no exception.

- Liquidity: Since the ETF will be listed on the National Stock Exchange (NSE), investors can buy or sell units on trading days, providing easy access and liquidity.

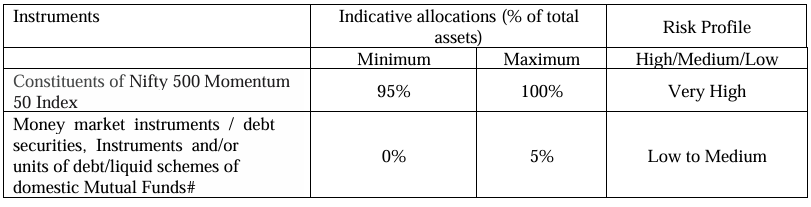

Groww Nifty 500 Momentum 50 ETF How Will Scheme Allocate its Assets?

Index top 10 constituents as on September 30 2024

| Company Name | Weightage |

| Trent Ltd. | 6.72 |

| Bajaj Auto Ltd. | 6.05 |

| Mahindra & Mahindra Ltd. | 5.04 |

| Adani Ports and Special Economic Zone Ltd | 4.71 |

| Siemens Ltd. | 4.43 |

| Bharat Electronics Ltd. | 4.36 |

| Hindustan Aeronautics Ltd. | 3.9 |

| Tata Power Co. Ltd. | 3.85 |

| REC Ltd | 3.82 |

| Suzlon Energy Ltd. | 3.54 |

What are the Risks Involved?

Like all equity-related investments, the Groww Nifty 500 Momentum 50 ETF comes with its own set of risks. Some of the key risks include:

- Market Risk: The performance of the ETF is directly linked to stock market performance, and any volatility can affect returns.

- Tracking Error: There may be small deviations between the ETF’s returns and the index it tracks, caused by expenses or market liquidity issues.

- Liquidity Risk: Although the ETF is listed on NSE, trading volumes may affect liquidity.

Groww Nifty 500 Momentum 50 ETF Investment Strategies

The Groww Nifty 500 Momentum 50 ETF aims to passively invest in stocks in the same proportion as the Nifty 500 Momentum 50 Index.

Its investment strategy focuses on maintaining close alignment with the index by regularly rebalancing the portfolio, accounting for any changes in stock weights and liquidity needs.

While most of the investments will be in equity, a portion of the fund may be allocated to debt and money market instruments to ensure liquidity. The scheme may also invest in other mutual fund schemes, all in line with its asset allocation strategy.

The fund’s performance depends on minimizing tracking error and maintaining portfolio alignment with the index. However, the scheme does not guarantee achieving its investment objective or delivering returns.

The Fund Manager of the Scheme

Mr. Abhishek Jain, who serves as both a Dealer and Fund Manager (Equity) at Groww, brings 12 years of experience in the equity market. At 39 years old, he holds a BA degree and is a Chartered Accountant by qualification.

Before joining Groww Mutual Fund (GMF), he worked as a Senior Dealer with Edelweiss Tokio Life Insurance.

His experience also includes working with Acko General Insurance and Shriram Asset Management Co. Ltd.

Mr. Jain manages several other schemes, including the

- Groww Nifty Total Market Index Fund,

- Groww Nifty Smallcap Index 250 Index Fund,

- Groww Nifty Non-Cyclical Index Fund,

- Groww Nifty EV & New Age Automotive ETF, and

- Groww Nifty India Defence ETF along with their respective Fund of Funds (FOF) versions.

How to Invest in the Groww Nifty 500 Momentum 50 ETF

Investors can participate during the New Fund Offer (NFO) period at a price of INR 10 per unit. After the NFO, the units will be available for trading on the NSE at market-determined prices.

To ensure that this ETF aligns with your investment strategy, it’s advisable to consult with a financial advisor.

Final thought

The Groww Nifty 500 Momentum 50 ETF presents a strong investment opportunity for those looking to capitalize on India’s momentum-driven stocks. With potential for significant long-term growth, this ETF is a great choice for growth-oriented investors who are comfortable with a certain level of risk.

Bonus

1.What is the minimum investment for Groww Nifty 500 Momentum 50 ETF?

The minimum investment during the New Fund Offer (NFO) period is ₹500.

2.How does the ETF track the Nifty 500 Momentum 50 Index?

The ETF invests in the same stocks as the index, aiming to replicate its performance as closely as possible.

3.Is there any exit load on the ETF?

No, there is no exit load applicable to this ETF.

4.What are the risks associated with the Groww Nifty 500 Momentum 50 ETF?

The primary risks include market volatility, tracking error, and the lack of defensive measures during market downturns.

5.Can NRIs invest in the Groww Nifty 500 Momentum 50 ETF?

Yes, Non-Resident Indians (NRIs) are eligible to invest in the ETF, subject to applicable regulations.